Ethnicity and Cannabis

Understanding the demographic profile of Cannabis Consumers

Published September 14, 2022

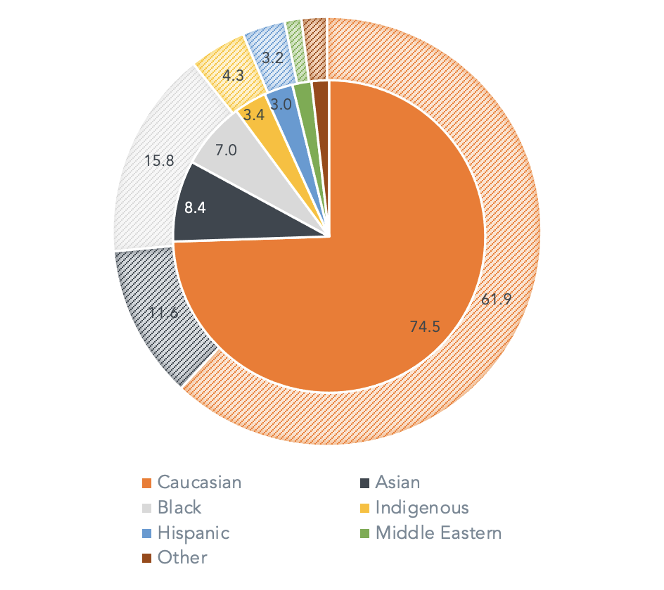

Canada is often described as a mosaic, made up of a wide variety of ethnicity and cultures. Caucasians make up the majority of the Canadian population (approximately 73%) and a similar importance of buyers to the cannabis market share (74%). The remaining population is composed of a variety of ethnicities who choose to consume cannabis in unique fashions and at different frequencies. This research is intended to understand how this mosaic of people interact with the cannabis industry.

Cannabis Incidence and Spend

Despite the gradual rise in cannabis incidence rates in Canada over the last 4 years, the demographic profile of cannabis consumers’ ethnicity has not changed dramatically. This year, ranked by percentage of buyers or spend, Asian and Black Canadians are the next most important consumer groups after Caucasians for this category. The remaining 10% of buyers and spend is made up of Indigenous, Hispanic, Middle Eastern and other ethnicities. Despite the strong majority of cannabis users being Caucasian, other ethnic groups are driving higher than their share of spend on the category.

Proportion of Buyers and Spend by Ethnicity (Inner Circle – Buyers, Outer Circle – Spend)

Cannatrack, n=14,925 Canadians, January 2022 to July 2022

Based on their population in Canada, certain groups such as Asian and Indigenous remain underdeveloped in their reported cannabis consumption. Each group is less likely to consume cannabis, however the users that do consume, spend a lot. Asians, including East Asians and Southeast Asians, represent over 8% of buyers but nearly double the proportion of marketshare (16% of spend).

Black Canadians are more likely to consume cannabis based on their population size, and these consumers also represent a larger portion of the market dollar share than expected. These consumers spend the most annually on cannabis, an estimated x3 the amount of the average cannabis consumer. Later in this article we’ll examine the frequency at which these consumers consume cannabis and how that impacts their importance.

While Hispanic cannabis consumers are more prevalent based on their population size in Canada, these consumers represent a small portion of the market. It’ll be important to monitor this group moving forward for potential grow as they respond most favourably to future consideration of cannabis consumption (50% responded they haven’t consumed but would consume, while all other consumer groups were under 40% for this question).

Consumption Frequency

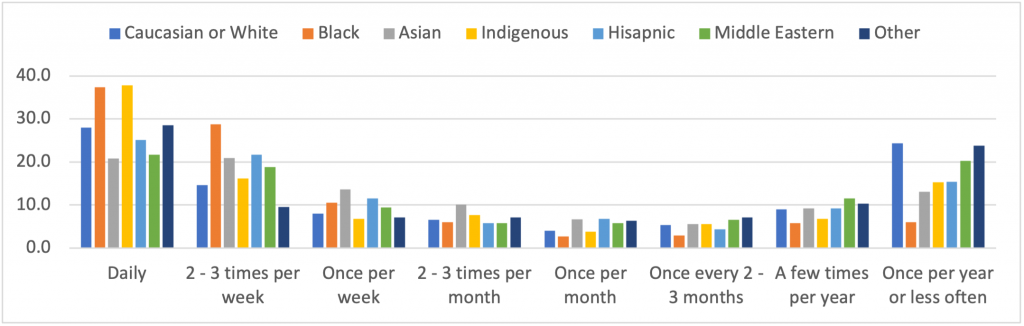

Typically, weunderstood cannabis consumption frequency to be represented by a ‘horseshoes hape’ shape below. The first uptick is driven by daily consumers, representing about 25% of respondents. As we decrease frequency of consumption, so do the number of consumers (14% are a couple times a week, 8% once a week, and so on). The ‘horseshoe shape’ shape starts to appear on the light end of consumption where 30% of users consume once per year or less often. This trend is led by the majority group of Caucasian consumers, and while for the most part this trend aligns across the remaining minority groups, there are some nuances to consider.

Consumption Frequency by Ethnicity Group

Cannatrack, n=14,925 Canadians, January 2022 to July 2022

Black consumers, who are overdeveloped in buyers and spend, have one of the highest rates of daily consumers (37% vs the Caucasian average of 28%). This group is also made up of a large portion of those who consume a few times a week. This group has the steepest curve from left to right, with few light/infrequency buyers. Therefore, when we look at the proportion of each ethnicity group by Heavy to Light consumers, we see Black Canadians have the highest proportion of Heavy consumers (at 77% vs the Caucasian average of 51%). As Heavy consumers should be the top focus for future success, ensure you’re attracting this group of consumers to your portfolio.

Asian Canadians have one of the flattest curves, with only 1 in 5 from this consumer group consuming daily. Despite the lower rate of daily consumers, Asians still have a greater proportion of Heavy consumers than Caucasians, and have the second highest spend rate on cannabis (second to Black Canadians). In fact, nearly all ethnicity groups have a higher proportion of Heavy or Medium consumers relative to Caucasians (excluding Middle Eastern and Other).

Proportion of Heavy, Medium and Light Buyers by Ethnicity Group

Cannatrack, n=14,925 Canadians, January 2022 to July 2022

How Do We Grow

Moving forward, there is no denying the massive importance that Caucasians provide to the market due to the presence of the population in Canada. However, for brands and retailers to grow, and as the Canadian landscape continues to evolve, we need to ensure we’re attracting a diverse group of consumers. Are you attracting the remaining 40% cannabis spend that’s on the table?